Record keeping, for many years, crypto taxes and trading crypto has, for many, been the land of the free. Literally. Governments around the world are starting or have crypto banned, regulated or legalized. In Canada, this is not the exception. Since 2016, the Canada Revenue Agency (CRA) has had rules around crypto how to tax currency.

Why the Onus of Keeping Records on Fall on the Taxpayer and not the accountant?

The Canada Revenue Agency (CRA), as with any auditor, wants to make sure that the report is appropriately supported by statements and summaries GENERATED BY THE CRYPTO EXCHANGE that has the taxpayer's name along with transaction details. Think of it another way, if you submit a claim report generated by you or by a third party/internal staff to the CRA and is ASKING FOR A HUGE REFUND; Prior to issuing a refund, the CRA will want to see actual documents, backing up and supporting your refund claims. These could be bank statements, customer or supplier invoices or any legal documents. Data that only the taxpayer can produce because the taxpayer has access to their own data. Similarly, the CRA will want to review and ensure that the data is GENUINE by checking statements and summaries verifying BOTH the purchase price and disposition value of all securities transactions for the year being reviewed/audited. The information has to be available when requested.

If you file your tax return electronically, the CRA may audit your return to verify a large refund, medical expenses, caretaker credits, and crypto losses/gains. That's why it is important to download all statements and CSV files for confirmation and upload the the CRA.

| For information regarding CRA's Record Keeping requirements, please go to: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/long-should-you-keep-your-income-tax-records.html |

What do I give my accountant for crypto taxes?

In order for a crypto tax accountant to be able to help process whether the trades were overall profitable or not – and therefore whether you owe crypto taxes, it is important to be able to have records available. Crypto exchanges are the on-ramp to the crypto world. A crypto exchange would the ones like Binance, BitBuy, Netcoins, among others. You would deposit your dollars by transferring your dollars by Interac Direct Deposit (also known as ACH in the USA), or by credit card payment into the crypto exchange. Once there, you would buy your cryptos. The exchange would have a record. The other way would be to manually record every transaction on a piece of paper, on an Excel file. The CRA requires the following information:

- the date of the transactions

- the receipts of purchase or transfer of cryptocurrency

- the value of the cryptocurrency in Canadian dollars at the time of the transaction

- the digital wallet records and cryptocurrency addresses

- a description of the transaction and the other party (even if it is just their cryptocurrency address)

- the exchange records

- accounting and legal costs

- the software costs related to managing your tax affairs.

By now, every major crypto currency exchange should have the ability to track some or all these requirements.

How do I find out if the crypto exchange has downloadable records?

The best way is to deal with exchanges based in Canada. They will most likely be able to meet the CRA record keeping requirements. However, if they are abroad, they will deal in their local currency and may not have complete information. At the very least, they will have the transaction date, the type of crypto and type of transaction.

What to look for?

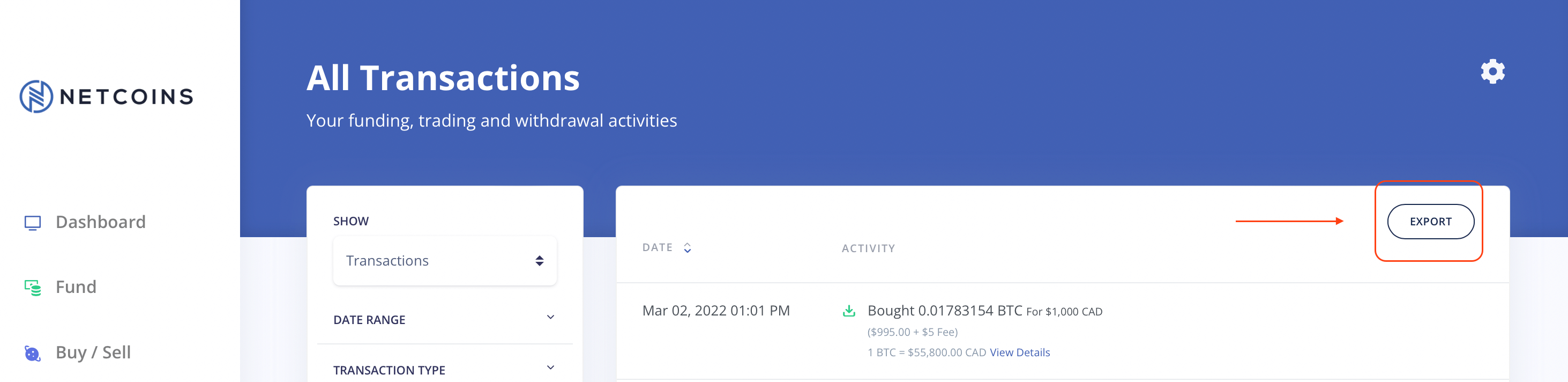

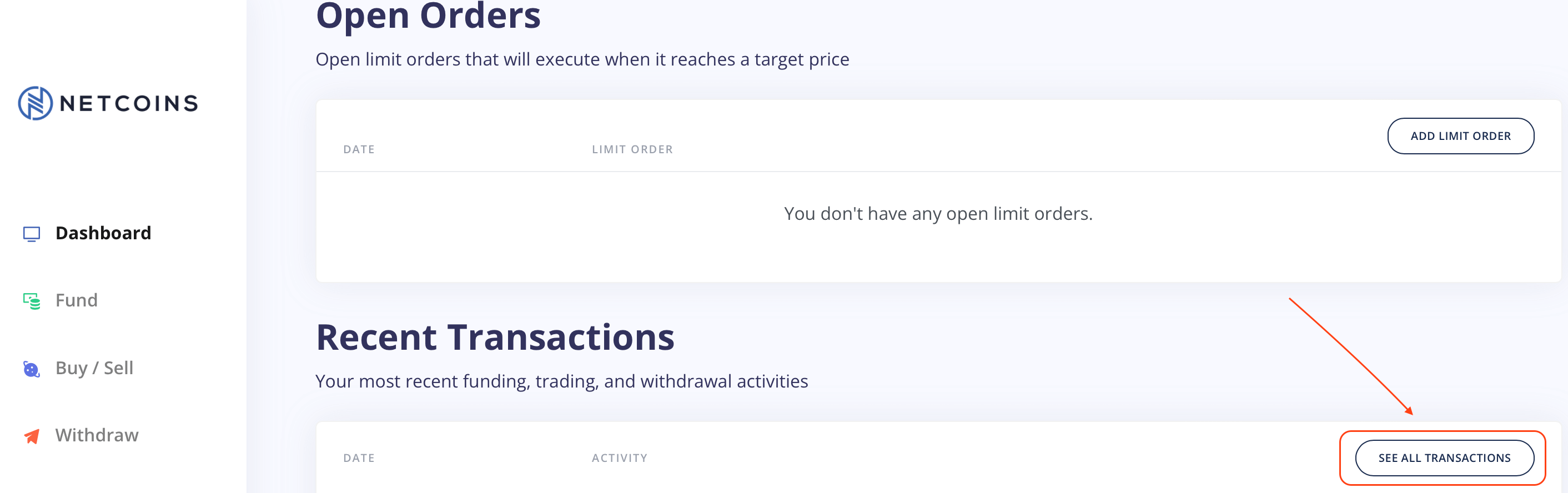

- when you’re at the crypto exchange, look for terms like “export” or “view all transactions” and look for “download all transactions” and “export to csv”.

- reach out to each of the exchanges for human help.

- If the exchange has a “help” section, check if there’s a search box function over. Use terms like “export transactions” to see what search results come back. There might be a knowledge base page that will show you how to obtain the transactions.

STEP 1: Getting to the download "all transaction" section

Step 2: Download the CSV file

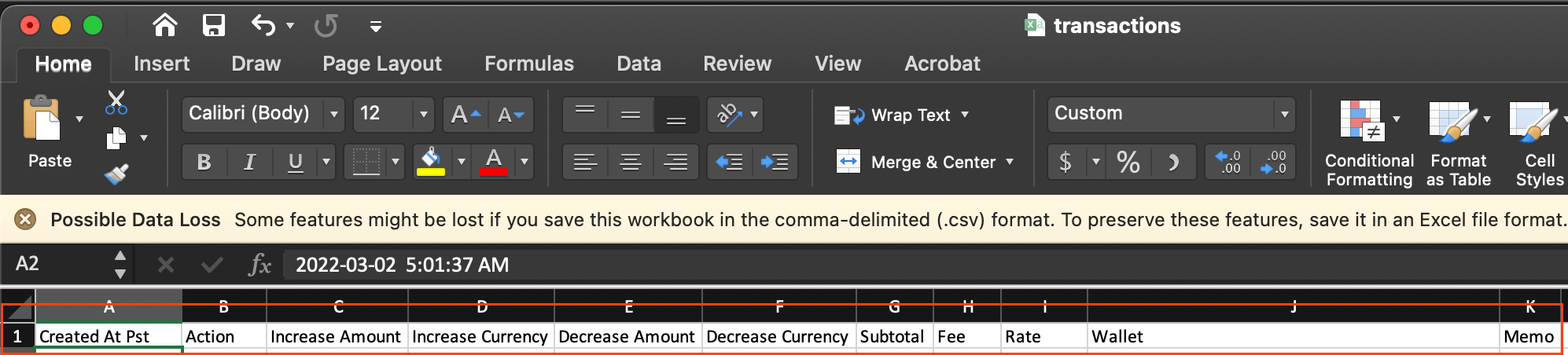

Step 3: You should end up with a CSV file as shown:

What about transactions recorded in the hardware wallet?

Cryptos can be stored in the cloud at the exchange or they can be transferred to a crypto wallet (a.k.a Cold Storage). An example of a crypto currency hardware wallet is Ledger Live. Ledger Live’s desktop application has the ability to download transactions in csv format. Unfortunately, the wallet doesn’t record the purchase cost of the crypto and doesn’t record the currency at the time of purchase used to buy or sell. Those elements are required by CRA and by a crypto accountant.

Reference:

Guide for cryptocurrency users and tax professionals

Related Articles